The Australian Electricity Market Operator (AEMO) has a pretty big job. It’s tasked with managing electricity and gas systems and markets across Australia, helping to ensure Australians have access to affordable, secure, and reliable energy.

AEMO produces a report called the Electricity Statement of Opportunities (ESOO), which provides technical and market data for the National Electricity Market (NEM) over a 10-year period to inform the planning and decision-making of market participants, new investors, and jurisdictional bodies.

A couple of weeks ago, AEMO published an update to the 2022 ESOO, and a couple of things grabbed our attention.

The first is that the timelines of proposed developments are constantly changing – usually not getting shorter. For example, you might have heard that Snowy 2.0 is more than 12 months behind schedule and there’s now a major issue with a tunnel boring machine that’s stuck in soft ground.

The second is that all the data in the world can’t anticipate everything. In the report, AEMO concedes that “large unserved energy events”, driven by weather uncertainty or other circumstances such as simultaneous generator and/or transmission outages, may erode available supply when it is required.

What’s changed since the 2022 ESOO was published?

According to AEMO, this February 2023 update to the 2022 ESOO has been issued in response to “material changes to available capacity in the NEM”.

Here are the biggest five:

1. Snowy Hydro has advised a one-year delay on the Snowy 2.0 hydro project from December 2026 to December 2027, and on the gas-fired Kurri Kurri Power Station from December 2023 to December 2024.

2. The Waratah Super Battery Project in New South Wales – with associated network upgrades, and system integrity protection scheme (SIPS) – is considered committed and scheduled for operation from late 2025.

3. AGL has brought forward its expected closure date for the 800 megawatts (MW) gas-fired Torrens Island B Power Station in South Australia from 2035 to 2026.

4. Origin Energy has reported a three-year extension to the operation of the 180 MW gas-fired Osborne Power Station in South Australia to 2026, and no longer advises closure on 31 December 2023.

5. The 123 MW gas-fired Bolivar Power Station in South Australia is now considered committed and is modelled as available over summer 2022-23.

What the updated 2022 ESOO says

While the latest update to the 2022 ESOO identifies numerous new developments that have increased the adequacy of supply in some regions, the changes to timing of other developments is cause for concern.

The update examines the adequacy of existing supply, considering only those developments which have completed all necessary approvals and met AEMO’s commitment criteria.

Here’s the crucial statement:

“Overall, there remains an urgent need for additional commitments to occur, including in dispatchable projects such as long duration storage, to satisfy reliability requirements over the next 10 years.”

What does “an urgent need” mean?

At the risk of confusing you with too many unfamiliar technical terms, we have to explain the measure AEMO is using.

The ESOO measures power system reliability using expected unserved energy (USE) and compares forecast USE against an Interim Reliability Measure (IRM) of 0.0006% and a reliability standard of 0.002% of the total energy demand in a region for a financial year.

The calculated level of firm capacity examines the level of firm, dispatchable, and continuously available capacity that would be needed to meet these relevant standards.

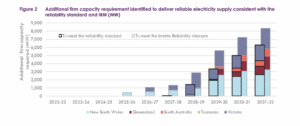

This table illustrates how much additional capacity is needed in the next 10 years.

AEMO states that to achieve this requirement, firm capacity solutions such as electricity storage are needed, particularly longer duration storage solutions most able to meet the breadth of system challenges that may lead to reliability risks.

While short-duration batteries, for example, may provide some level of firming capacity, the capability to service reliability risks of longer durations is needed to replace retiring dispatchable capacity through longer and broader risk coverage that addresses these gaps.

There are projects underway that will make a difference

While only taking into account “developments which have completed all necessary approvals and met AEMO’s commitment criteria”, the report recognises that there is the potential for more developments to come online in the forecast period.

Among numerous developments under consideration that have the potential to significantly reduce forecast USE are:

1. The HumeLink and Hunter Transmission Project (NSW);

2. A 380 MW tender for firming infrastructure (NSW);

3. Investments to develop 33,600 gigawatt hours of renewable electricity per year and 2 GW of long-duration storage by the end of 2029 (NSW);

4. 457 MW (1,678 MWh) of anticipated battery developments (NSW);

5. The 350 MW (1,400 MWh), four-hour, large-scale Wooreen Battery (Vic);

6. 290 MW (550 MWh) of other anticipated battery developments in Victoria;

7. The potential for 542 MW (660 MWh) of anticipated battery developments in South Australia;

8. The Victorian Offshore Wind Policy, which includes procuring at least 2 GW of offshore wind by 2032; The Victorian energy storage targets to develop 2.6 GW of energy storage by 2030 and at least 6.3 GW by 2035.

We think AEMO is saying: “Be alert, not alarmed”

In summary, while we will need more generation and longer-duration storage capacity within the next 10 years, at least AEMO – on behalf of governments and the energy industry – is on top of it.

While AEMO is flagging an “urgent need” for additional commitments, it also recognises that those sorts of commitments are being made all the time.

Everyone is on the same page, but AEMO isn’t sugar-coating things. If we don’t get what we need, there’ll be blackouts and brownouts in the future.

However, if the industry and our governments do what they plan to do, all Australians will continue to have access to affordable, secure, and reliable energy.